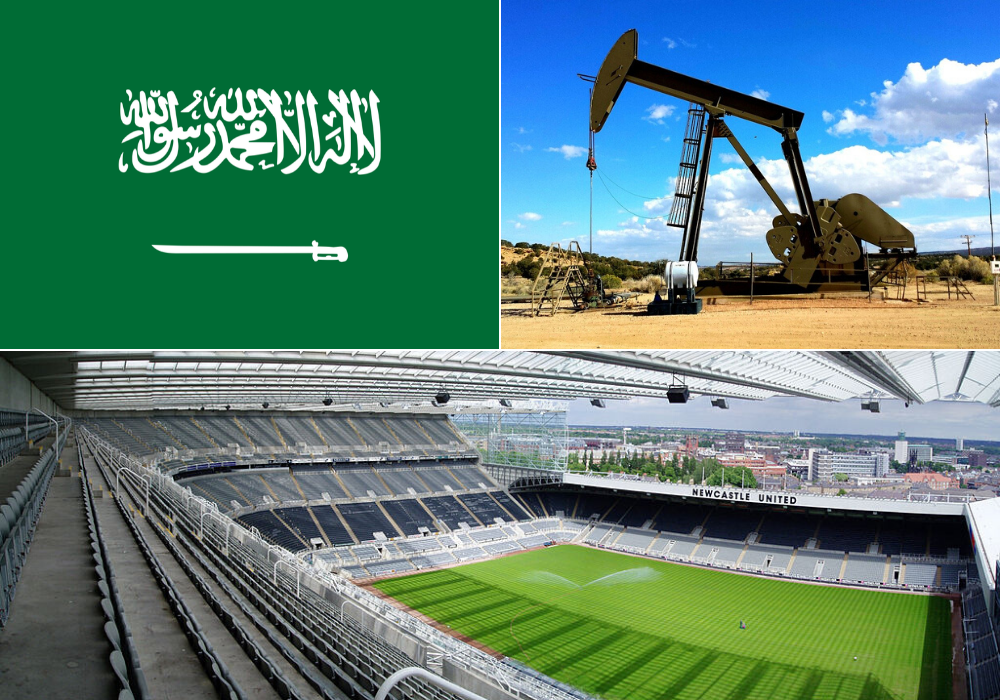

Much has been written about the “sportwashing” reasons for an impending Saudi Arabia-backed takeover of a Premier League football club but, from a wider perspective, does the questionable timing of the Newcastle United bid suggest the end of oil’s dominance in the future energy mix? Dan Robinson analyses the fuel’s role within the Saudi Vision 2030 project and whether the Kingdom has finally accepted a need to diversify away from hydrocarbons.

On 8 March, Saudi Arabia shocked the world when it launched a price war against former ally Russia to trigger a historic collapse in the price of oil.

Five weeks later, on 14 April, the UK’s business registrar Companies House published financial documents that revealed British financier Amanda Staveley had made a breakthrough in a bid to buy Premier League football club Newcastle United.

These two events may appear unrelated at first, until the finer details of the mooted £300m takeover show that Saudi Arabia’s Public Investment Fund will take a reported 80% stake in the club.

Should the move go through — which it’s expected to, pending Premier League checks, despite mounting opposition from across the board citing human rights abuses, state-sanctioned murder accusations and broadcasting piracy — it perhaps comes at a highly significant time for the Kingdom.

The coronavirus pandemic, which has transformed societies by instigating worldwide lockdowns and reduced energy demand on an unprecedented scale, has taken a sledgehammer to the oil and gas industry at a time when the planet is already being weaned off fossil fuels in favour of increasingly cheaper renewable energy.

For a country such as Saudi Arabia, where oil and gas represents about 87% of its national budget revenues, 42% of GDP and 90% of export earnings, this spells bad news.

But it also helps us to understand why it has sped up the acquisition of a football team that may not initially feel like a wise investment in an economic climate that is forcing Crown Prince Mohammed bin Salman to rein in some of his Saudi Vision 2030 grand reform plan, at least in the short term.

Vision 2030, after all, is a programme that aims to diversify the Saudi economy into areas including tourism, infrastructure, health and recreation.

Having a seat at the top table of the world’s most-watched league in the globe’s most popular sport will play a major part in drawing attention to all this.

“Saudi Arabia desperately needs to diversify,” says Professor Paul Stevens, an academic expert on the Middle East.

“It should have been doing it since 1973 and every time the oil price collapses, it talks about the need to diversify and cut back on expenditure – but when the price recovers, the imperative to do so disappears.

“This time around, for a number of reasons the oil price isn’t going to go back to the sorts of levels we saw a few years ago because we’re in the middle of an energy transition and moving from hydrocarbons to electrons.

“In my opinion, the energy establishment — groups like Opec and others — is seriously underestimating the speed and depth of that transition.

“That was even before the pandemic but, in these circumstances, clearly the writing is on the wall for the end of oil — which, at the moment, means the end of Saudi Arabia as an economic powerhouse unless it can diversify — so there’s a greater imperative for it to do just that.

“Acquiring something like Newcastle United fits in with Vision 2030.”

While many opponents to the takeover, perhaps with some justification, accuse the Kingdom of attempting “sportswashing” — a term given to countries with poor human rights records that use popular sport to improve reputations — could the fact it looks set to go ahead suggest Riyadh has finally accepted the dominance of oil and gas in the global energy mix is nearing an end?

Role of oil in Saudi Arabia’s energy mix

Before we get to Vision 2030, it’s useful to retrace the Kingdom’s energy mix. Roughly 60% of Saudi Arabia’s power generation comes from natural gas, with the remainder mostly comprising oil and feedstock.

The country’s 20% oil share in electricity production reported by the World Bank in 2015 is way above the 3% global average.

Over the past decade, the Kingdom has increased its oil production by two million barrels per day, but there’s also been a big push to develop natural gas capacity and petrochemicals.

“On paper, natural gas is the cheapest source for baseload power and isn’t very polluting compared to other hydrocarbons, so it’s the technology of choice,” says Fabrice Abalain, a regional analyst for the Middle East and North Africa in the Energy Industries Council (EIC) trade association’s Dubai office.

Renewables account for less than 1%, as ambitious schemes — including a $200bn project to cover hundreds of square kilometres of desert with solar panels, announced in March 2018 but scrapped seven months later — rarely get off the ground. Coal and nuclear have no role in the Saudi energy mix.

Abalain believes the Kingdom will eventually wake up to zero-emission sources as prices drop – solar has the greatest potential due to the country’s vast desert, and there are hopes it could increase its share of power generation to beyond 20% in a decade – but until energy storage technologies bear fruit, oil and gas will reign supreme.

While gas is the most important energy source in generating power for 34 million Saudis, crude oil wears the crown for exporting.

Seven refineries produce crude and other oil products that make up the 90% of national exports.

The state-owned oil industry is responsible for 45% of the Kingdom’s GDP, versus the private sector’s 40% contribution — which for most countries is at least 60%, according to the International Monetary Fund.

The public face of Saudi industry, its “crown jewel”, is Saudi Aramco, the world’s biggest oil producer with an estimated 270 billion barrels in reserves — supplying about 10% of the planet’s crude oil.

It is also by far the world’s most profitable company— eclipsing tech giants such as Amazon and Google parent company Alphabet.

Aramco made an $88bn profit in 2019; second top earner Apple generated $55bn in profits the same year.

In November 2019, the oil company made 1.7% of its shares publicly available for the first time on Saudi Arabia’s Tadawul stock exchange. Its $1.7tn valuation made it the most valuable IPO in history, with CEO and president Amin Nasser saying “it will increase our visibility internationally”.

Abalain says: “It’s the most important company for Saudi Arabia but it’s not a large economic partner for Europe because its main markets are Asia and the US. Russia is probably the biggest oil producer for Europe.

“Probably its biggest interest in Europe is through SABIC, the world’s fourth-largest petrochemicals company with operations in Europe, and Aramco bought 70% shares in it last year.”

The company’s success lies in its ability to produce cheap oil, with information shared as part of the IPO preparations showing it costs $2.80 to get a barrel from the ground that could then be sold for $62 according to last year’s prices.

Ellen Wald, author of a book about the Kingdom and Aramco called Saudi, Inc, told NPR in November: “It produces oil for so much less than anyone else out there. I mean in the United States, a fracking company is lucky if it can break even at $50 a barrel.”

But that all changed this year with the ripple effect of the Covid-19 pandemic. The introduction of lockdowns and travel restrictions around the world have decimated oil demand, which the International Energy Agency now expects to fall by a huge 8.6 million bpd this year.

The demand shock, coupled with a massive oversupply exacerbated by the Saudi-Russia price war in March after the failed Opec+ negotiations to address the health crisis, sent oil prices into rapid freefall.

And while a gradual rebalancing of the market delivered a rebound in May, the key benchmarks, Brent and West Texas Intermediate (WTI), remain at just half their value compared to the start of 2020.

All this has hit the bottom line at Aramco, which cut production from 12 million bpd to 7.5 million bpd in two months, as first-quarter earnings for 2020 dropped by 25% to $16.7bn compared to the previous year’s $12.2bn posting.

It’s also worth noting that even though last year’s IPO set headlines for its huge valuation, it wasn’t quite the success MBS had envisioned, generating $25bn – a quarter of the original target, although that was based on an initial projection to sell 5% of shares rather than the eventual 1.7%.

Abalain believes the economic impact of Covid-19 and the oil price crash will be huge for Saudi Arabia.

He adds: “No one wants to have a high oil price because it creates increased competition from other technologies but a low price is very bad news for both Saudi Arabia and Russia, as well as the US.”

Vision 2030: How Saudi Arabia wants to reduce future reliance on oil

Covid-19 would have sounded like something from a far-fetched sci-fi movie when the Saudi Vision 2030 strategy was revealed in April 2016.

But the pandemic has been an early test for a long-term economic blueprint that plans to raise the share of non-oil exports in non-oil GDP from 16% to 50% to find new ways of developing a “prosperous and sustainable economic future”.

In a press conference, Prince Mohammed – known as MBS and the brainchild of the scheme who would be awarded the title of crown prince the following year – told journalists the Kingdom could achieve its objectives with oil at just $30 per barrel.

But he added: “We think it is almost impossible to go under $30 because of global demand.”

A newly-diverse Saudi economy being proposed would involve localising renewable energy and industrial equipment sectors, while investing in digital infrastructure, culture, education and the military.

Abalain believes the young population has been a key consideration for the rulers.

Two-thirds of the population in 2012 was aged under 29 – compared to 41% in the US, as an example — meaning new jobs would need creating for a changing workforce that may increasingly accommodate women, who have pushed for reforms in the ultra-conservative state.

“How do you give them a new kind of society and bring Saudi Arabia to the international stage, so it’s not just seen as the oil provider of the world but actually a real destination for business?” asks Abalain.

A huge pillar of reform involves creating a tourism offer for Westerners that would grow the annual number of foreign tourists from 15.3 million in 2018 to 100 million in 2030, create a million jobs and increase the sector’s share of GDP from 3.8% to 10%.

It’s involved launching a new visa system for visitors, relaxing female dress codes and throwing big money at projects like the $8bn “entertainment city” Qiddiya, near Riyadh.

“Saudi Arabia really wants to show it has other channels than just Aramco,” adds Abalain.

But in a December 2019 report, Castlereagh Associates Gulf tourism analysts Daniel Moshashai and Rachna Uppal wrote such ambitions were unlikely to be fully realised due to “geopolitical risks in the region and the generally negative press surrounding Saudi Arabia”.

Such sentiments are why Prof Stevens is among a cohort of academics who label the vision “Mirage 2030”, noting it requires a new Saudi economy to be built virtually from scratch but is hugely dependent on the country’s private sector stepping up to the plate.

“But the private sector is very weak because there’s no property rights in Saudi Arabia,” says the Chatham House research fellow, who is also an emeritus professor at the University of Dundee.

“If you’re a citizen with assets, there’s nothing to stop the government taking them, as we saw in the Ritz-Carlton incident [where MBS reportedly detained hundreds of Saudi royals, billionaires and government officials in 2017, and told them they must sign away large chunks of their assets to be released].

“So the private sector is reluctant to get involved with Saudi Arabia.”

Importance of Saudi Public Investment Fund in diversifying the economy in future away from oil

Nevertheless, the Saudi government is moving full steam ahead with its transformation strategy and a key part of the Vision 2030 jigsaw is the Public Investment Fund (PIF).

Set up in 1971 as a “custodian” of government stakes in companies and to finance domestic projects, the sovereign wealth fund was earmarked by MBS in 2015 to drive forward his economic reform plan.

It now has about $325bn in assets with plans to increase this to $2tn by 2030, while the crown prince – who sits as chairman of the PIF — wants to raise the international exposure of its assets to 25%.

After announcing itself as a major player in 2016 with a $3.5bn stake in Uber and $45bn injection into SoftBank’s $100bn Vision Fund for backing ambitious tech start-ups, the PIF has taken centre stage during Covid-19 by making not insignificant bets on companies hit badly by the crisis.

Among the recent investments have been a 5.7% stake worth $500m in US entertainment group Live Nation, a 7.3% holding in the world’s largest cruise line operator Carnival and a series of small stakes in huge brands like Disney, Facebook, Boeing and Citigroup. These estimated by the Financial Times to have cost at least $7.7bn collectively.

As the PIF governor Yasir al-Rumayyan – primed to be Newcastle’s new chief executive should the takeover be approved – told a virtual conference in April, “you don’t want to waste a crisis … so for us, definitely, we are looking into any opportunities”.

The problem with investing at a time when the economy is crippled is the buyer can also be feeling the heat.

And alongside Aramco’s weaker-than-expected Q1 results, a projected -3.2% GDP contraction for 2020 has led to suggestions of Saudi austerity and cuts in spending for the Vision 2030 project this year. It means some of the Crown Prince’s grandest dreams could be put on ice.

University of Oxford modern history lecturer Mark Almond has compared the current oil price war to the 1986 crisis that, dovetailed with the Chernobyl disaster, “symbolised Soviet incompetence” and led to the collapse of Communism.

Writing in the Telegraph in April, he said: “Another geopolitical upheaval is on the cards, but this time West and particularly its Arab allies could be the losers.

“Saudi Arabia could afford its price war with the Kremlin in the 1980s. The Kingdom’s population was much smaller and so demands for social spending far lower.

“Its budget today is sorely taxed by the Crown Prince’s ambitious modernisation agenda, the generous subsidy of its growing population and the costs of the war in Yemen.

“To break even given its full-throttle expenses, Saudi Arabia needs oil prices to be around $80 a barrel.

“The Kingdom is running a budget deficit and a prolonged oil price crash could do for Saudi Arabia what it did for the Soviet Union in the late 1980s.”

Prof Stevens adds: “With the oil price situation as it is now, this pushes Vision 2030 to Vision 2050 or even 2090 because of the lack of revenue as a result of a lower oil price.”

It means economic diversification has never been more important.

Saudi Arabia increases investments in sport

Like 24 Hours of Le Mans, the Indy 500 and Monaco Grand Prix, the Dakar Rally occupies a prized spot at the top of the racing calendar.

Four weeks before the starting gun was fired in the Saudi port of Jeddah, the “Clash of the Dunes” heavyweight boxing match between Anthony Joshua and Andy Ruiz Jr was held at the UNESCO World Heritage site of Al-Turaif, in Riyadh.

There was also the inaugural Saudi Cup, billed as the world’s most valuable horse race, on 29 February this year as the Kingdom has poured hundreds of millions into showcasing it as a destination for big-ticket events.

But perhaps the most significant move is the takeover of Newcastle United. The club, based in the north-east of England, has a history stretching back to 1892 and has been a fixture in the Premier League for all but three seasons since its breakaway from the English Football League in 1992.

Despite a largely unsuccessful recent past, the club can command full-capacity crowds at its 52,000-seater stadium and has often been listed in the Deloitte Football Money League of the world’s 20 richest clubs.

This ranking owes largely to the pulling power of the Premier League, which is the most-watched sports league in the world with a claimed TV audience of 4.7 billion people — a calculation based on the fact it is broadcast to 643 million homes in 212 countries.

The cosmopolitan nature of the competition isn’t just the scores of nationalities that take to the field, but in ownerships too.

British, American, Russian, Chinese and Italian businessmen are among the purse controllers, while the precedent for a state-backed takeover was set when the Abu Dhabi deputy prime minister Sheikh Mansour bought Manchester City in 2009 and turned a mediocre club into one of the dominant forces in the sport.

And outside England, Qatar’s ruler Sheikh Tamim bin Hamad al-Thani has been owner of Paris St Germain since 2011 through the state-owned Qatar Sports Investments.

It’s against this backdrop that buying Newcastle for a mooted £300m figure begins to make sense.

Abalain says: “It looks like the takeover comes at a good time for Saudi Arabia but it’s part of the same strategy as the Dakar Rally and other sports investments, which are part of the Vision 2030 programme.

“Sport gives it an easy access to the masses through the media as so many people watch football, particularly the Premier League — it’s basically the number one place to be, as the UAE has found with Manchester City and Qatar with PSG.

“It’s really the tip of the iceberg for the conservative Saudi economy, which has almost exclusively been tuned into oil exports.”

Is Saudi Arabia takeover of Newcastle United as much about economics as ‘sportswashing’?

Each Saudi investment into sport has been met with major opposition due to the perception it is attempting to “sportswash” its human rights abuses, with Hatice Cengiz writing to the Premier League on several occasions urging it to stop the Newcastle takeover.

She was the fiancée of Washington Post journalist Jamal Khashoggi, who was murdered and dismembered at the Saudi consulate in Istanbul, by agents of the Saudi government in October 2018 after he had frequently criticised the regime.

The CIA later concluded MBS, the would-be de facto owner of the English football outfit given his role as the PIF chairman, ordered the assassination – something he denies.

Abalain accepts the takeover would be an exercise in soft power by presenting the idea of a “new Saudi Arabia” that is less repressive and ultra-conservative, but says it could also open up new economic avenues

“Sport is clearly part of Vision 2030 because having a club in the Premier League is like having a ‘tribune’ to speak at the table of the hyper-rich — it’s kind of a must-have,” he adds.

“I don’t think it’s a way to replace or change the nature of Saudi Arabia. It’s really about diversifying and going where it hasn’t yet.

“Before Vision 2030, the economy was just about exporting oil, which it’s always been very good at doing and this won’t change.

“Saudi Arabia will remain one of the largest, if not the largest, oil exporters in the world – and it’s committed to being one of the largest for at least decades to come.

“Living in the Middle East for some time, I feel like people here are very sure oil won’t disappear.

“The global population is 7.5 billion and there could be nearly 10 billion people by 2050, so energy demand will only increase.

“Many of these extra people will be in Africa and Asia-Pacific, where access to energy is an issue. It’s very unlikely that any new technology will be able to challenge oil in the next 20 to 30 years in these parts of the world.

“So these investments are by no means suggesting we’re moving away from oil – it’s just about making more money. If the core business is oil then it wants to create more revenues.”

Prof Stevens questions the sense in splashing £300m on a Premier League club during the current economic conditions as heavy investment without much prospect of large returns will be required in the short term, but understands the PR motive.

“Gulf countries are so competitive,” says Prof Stevens. “If one does something, the others have to follow.

“Given the roles in Man City and Arsenal [sponsored by Dubai-based airline Emirates], there’s this obsession by Saudi Arabia to say ‘we’re as good as the UAE’.”

But the headlines showing the Kingdom financing superstar footballer signings could cause a backlash if the economy at home isn’t kept in shape.

He draws parallels with the 2011 Arab Spring, which was sparked by a deep sense of disillusionment with how countries were being run and resulted in the downfalls of governments in Egypt, Tunisia and Libya.

He explains: “There’s a social contract issued by the rulers of Saudi Arabia to the people, which says ‘we will provide jobs and government subsidies but in the meantime you will shut up and do as you are told’.

“If the revenue isn’t there, then it’s worth reminding people about what happened in the Arab Spring because if jobs are taken away, it’s highly likely that Saudi Arabia will suffer the same problems.

“There’s going to be some unemployed person in Riyadh asking why his country is spending all this money on some football club in the north-east of England.”

What does the Saudi Arabia PIF takeover of Newcastle United say about the future of oil?

Ultimately, the amalgamation of the oil price war, Covid-19 and Newcastle takeover have shone a spotlight on a delicate situation for both international relations and the future of oil.

The price war, for which Saudi shoulders much of the blame along with Russia, has soured its relationships with not only the Kremlin but the US — whose shale and oil industries are on their knees as a result of the break-up of the Opec agreement at a time when tensions were already building due to the Khashoggi murder.

MBS is making a number of enemies at a time when the Kingdom needs friends, with oil demand now falling in Europe and about a decade away from peaking in its core market Asia, according to Prof Stevens.

“The reality is that the future of oil is strongly in question and therefore dependence is not good news for any economy – not just Saudi Arabia but other countries in the Middle East,” he says.

It means realising the goals of Vision 2030 has never been more important to Riyadh.

Abalain believes the Newcastle takeover “feels like good timing” as making friends in Europe becomes a priority when it could be on the brink of losing an ally in the US.

He adds: “Ultimately, what Saudi Arabia is very afraid of is an inability to sell oil. With rising tension between Saudi and Iran, a conflict in Yemen and tension in Libya, it needs to feel more secure during a difficult period.

“At times like this, it’s useful to have economic partners. So it needs the likes of the UK and France to buy arms from, and being in the Premier League could be a way of broadening its partners further.

“Part of that is to get into Europe to find different ways of doing business and communicating with countries on the continent, and to be seen in different ways than just an energy sphere.

“Sport is a great way of doing that. It’s definitely Saudi Arabia trying to get its Vision 2030 into action and make it seen as having potential for the European market.

“And while it won’t stop relying on oil reserves during this energy transition, which will take a long time, we’re going to see a lot more diversification that’s necessary for Saudi Arabia to show the rest of the world.”