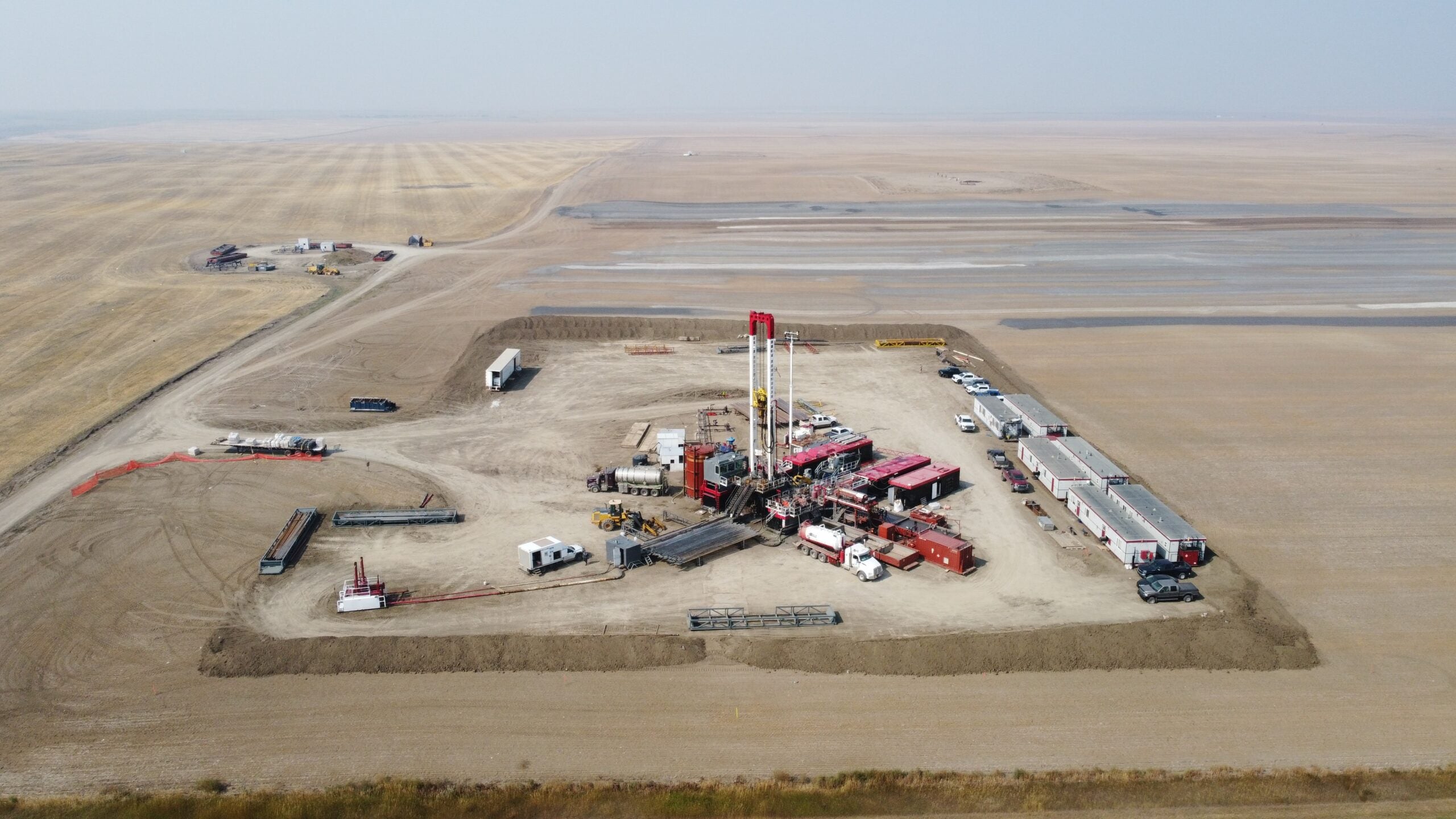

Prospera Energy Inc. has completed the drilling of four horizontal wells of the ten well multi-pad infill drill program. These wells encountered structure and pay as expected with excellent oil show throughout the pay. The drilling technique tweaked from the pilot wells were executed efficiently and ahead of schedule. High praises to Lasso Drilling Corporation for the effective synergy with Prospera to attain efficiency. These drilled horizontals are being completed and tied-in to existing infrastructure. Turnaround time to bring the production online is approximately two to three weeks; two horizontal wells are already completed. The production will be brought on gently initially to optimize recovery due to the heavier fluid properties. The full deliverability can be attained, approximately, over a three-month period. The next set of four horizontals are to commence within one week, barring any weather-related delays.

This multi-pad infill drill program stems from a comprehensive geological, seismic, and reservoir management delineation. The infill program is designed to optimize recovery with optimum wells in a cost-effective manner, while also aligning with planned enhanced and improved recovery techniques. As previously announced, this ten well program can approximately add an additional 750 bpd at a low decline to Prospera’s current 900+boepd. This infill development is intended to accelerate production and recovery to capture the significant remaining heavy oil reserves (400 million bbls).

The medium-light oil spud will follow the heavy oil horizontal well transformation from vertical wells in the latter part of this month. These slanted drills are awaiting the preparation of the new leases, surface facilities, and connecting pipelines. The medium-light oil development entails six to eight directional wells that can add an additional 600bpd (gross) at 50%, WI diversifying Prospera’s product mix and improving margin.

Overall, this Phase 2 development plan will allow Prospera Energy to become a low-cost producer with a significant increase in production. Restructured Prospera primary focus subsequent to increased production and corresponding revenue is to address all legacy arrears (especially, land owners & local community vendors), stay current with payables, and maintain services with comparable terms. Meanwhile, PEI will continue to execute its liability management plan to reduce the asset reduction obligations.

Interest Payable Reduction Settlement

PEI announces that the Corporation has accrued indebtedness to the Corporation’s convertible debenture holders (the “Creditors”) in the amount of $376,050.76 (the “Debt”) for interest expenses. The Corporation has the option to pay Creditors interest in either cash or in shares at market price, at the Corporation’s discretion, and has agreed to settle the Debt by the issuance of fully paid common shares in the capital of the Corporation (“Common Shares”).

This interest payable will reduce the current liabilities, in turn further improving its current ratio and liabilities related to the settlement of historical arrears. The Corporation intends to settle the Debt at a price per Common Share of $0.105, for an aggregate amount of 3,581,434 Common Shares. The common shares will be subject to a four-month hold period. The transaction is subject to the approval of the TSX Venture Exchange.