The recent legal blocks on three US pipelines has caused a wave of uncertainty across sections of the nation’s oil and gas industry.

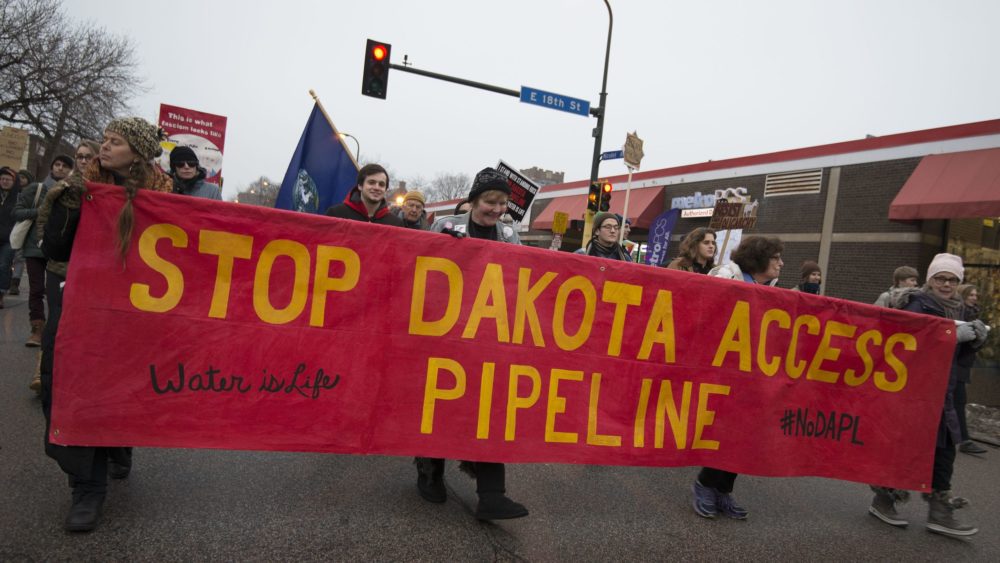

Following the cancellation of the Atlantic Coast Pipeline (ACP) on 5 July, less than 24 hours later a judge’s ruling shut down the Dakota Access Pipeline (DAPL), before the Supreme Court then prohibited any further development for now of Keystone XL on 6 July.

The news comes after President Donald Trump had tried to de-regulate several processes in the oil and gas industry to encourage development and production, with the White House chief giving the DAPL project his backing during the 2016 presidential election.

Adrian Lara, senior research manager of oil and gas at data and analytics firm GlobalData, said the ruling just “adds to the uncertainty and risk associated with building new pipelines, due to environmental and native American reservation-related challenges”.

“I think this highlights the role environmental groups and related legislation plays in US politics, and I believe this is the way it will continue to be,” he added.

“In my opinion, this will indeed discourage some companies to invest in pipelines but lobbying from the oil and gas industry will do its part to counter.”

Issues behind the Atlantic Coast Pipeline

The ACP, which was being developed by Virginia-headquartered Dominion Energy and North Carolina-based Duke Energy, was set to stretch 600 miles from West Virginia to North Carolina — pumping 1.5 billion cubic feet of gas a day.

The decision to cancel the project by the two US utilities was made just days after delays and legal challenges meant costs had risen to almost $8bn.

Dominion’s CEO Thomas Farrell and Duke’s CEO Lynn Good said in a joint statement that the announcement reflected the “increasing legal uncertainty that overhangs large-scale energy and industrial infrastructure development in the US”.

The pair added that, until the issues are resolved, the “ability to satisfy the country’s energy needs will be significantly challenged”.

According to Mason Maclean, Wood Mackenzie’s North American gas senior analyst, the cancellation of the ACP “reflects a trend of increasing project cancellations caused by legal challenges and regulatory delays”.

He added that, while these developments have been “concentrated in the north-east”, they are “beginning to impact other regions, such as the Permian”.

Impact of the Atlantic Coast Pipeline cancellation

Wood Mackenzie does not expect the cancellation of the ACP to result in north-east takeaway capacity constraints in the near to medium-term.

The energy research firm recently analysed a scenario that included a cancellation of ACP and found “minimal impact on regional basis and Henry Hub gas prices through to 2024”.

Maclean said the region, especially in the south-west Marcellus and Utica, has ample spare capacity over that time frame to “support north-east production growth, despite the cancellation”.

“In the longer term, however, north-east supply growth may become constrained without enough long-haul takeaway pipelines, which may place downward pressure on regional basis,” he added.

“Additionally, that constrained north-east supply may necessitate a call on higher-cost supply to fill the gap, which could drive some upward pressure on Henry Hub prices.”

Just after the ACP’s cancellation, the Supreme Court allowed most oil and gas pipelines to go back into effect under Nationwide Permit 12 (NWP 12) — a long-standing, streamlined blanket approval from the US Army Corps of Engineers for water body and wetland crossings under the Clean Water Act.

But Keystone XL, which is a 1,179-mile pipeline project running from the oil sands of Alberta, Canada, to Texas, US, has not been granted the necessary NWP 12 approval to continue at the moment in time.

Judges sided with environmental groups and now the proposed pipeline is required to undergo an arduous review before construction can resume.

Maclean said this decision will not change the cancellation of ACP, but it does “begin to clear a path for construction to restart on projects like the Mountain Valley Pipeline and the Permian Highway”.

Impact of the ruling on the Dakota Access Pipeline

Following a US district court’s ruling on the largest outbound pipeline to the Bakken oil field in North Dakota, the $3.8bn DAPL shall be emptied within 30 days – once again due to environmental concerns.

If this decree remains in place, hundreds of thousands of produced barrels per day will lack an export route in 2020, according to Rystad Energy, an independent energy researcher.

It claims this is because alternative options, such as other existing pipelines or railway transportation, will not be able to “fully take on the burden until next year”.

Assuming that the DAPL is unavailable for transportation from August 2020 and that rail exports remain at 300,000 barrels per day (bpd), Rystad said that leaves about 750,000 bpd of available pipeline capacity (assuming maximum utilisation) and local refining demand.

“Initially, this sounds like more than enough to absorb the 900,000 bpd of Bakken oil production from May 2020,” the researcher added.

“However, we must remember that production declines in April and May were predominantly driven by curtailments — most of these volumes will come back during the summer, assuming that a $40 WTI environment persists.

“The reactivation of curtailments will likely push state-wide oil output back to an average of 1.2 million bpd in the second half of 2020.

“Hence, with 300,000 bpd rail exports, remaining pipelines and local refineries alone will need to absorb 900,000 bpd of production.”

Rystad believes this scenario is “practically impossible in the short-term” and that existing infrastructure “cannot even deliver 100% utilisation on its theoretical 750,000 bpd capacity”.

Artem Abramov, Rystad Energy’s head of shale research, said there is a risk for “significant bottlenecks” and local differentials will be “completely blown out as soon as DAPL becomes unavailable”.

“It is already possible that some exploration and production firms in Bakken will consider the delayed reactivation of curtailments as a potential risk, given the lack of attractive transportation options from Bakken in the second half of 2020,” he adds.

Potential long-term impact of the pipeline blocks

GlobalData’s Lara said the US oil and gas industry is currently being “much more negatively impacted by the ongoing pandemic crisis” than the pipeline issues.

After years of high production rates for shale oil and gas, the industry is currently facing some of its biggest-ever challenges following the effects of coronavirus and a drastic drop in energy demand.

That drop in demand has already led to 19 of the nation’s smaller companies filing for bankruptcy this year, according to Texas-based law firm Hayes and Boone.

“Right now, and perhaps over the next 24 months, the real blow and issue is more about whether the production of oil and gas in the US will come back to levels before the pandemic,” added Lara.

But he does admit that having restrictions in building pipelines does not “sit well with plans for future developments”, such as new fields for transportation capacity.

He said Canadian producers have also been negatively affected by the pipeline decisions, as they “rely on that transportation to move their crude oil out of the landlocked Alberta province”.

The decisions to block the pipelines adds to the risk of “creating supply gluts and ultimately impacting the price of their Alberta crude oil”, claims Lara.

For him, the “bottom line issue” is that regulation takes time delaying projects and increasing cost, but it “does not mean that pipeline projects cannot be approved”.

He added: “I think companies will eventually find a way to incorporate this into their planning timeframe.”