The Moblan Lithium Project is an open pit greenfield lithium mine located in the northwestern Québec, Canada.

The project is owned by North American lithium producer Sayona Mining (60%) and SOQUEM (40%), a wholly owned subsidiary of financing corporation Investissement Québec.

Lithium was discovered on Moblan in the 1970s and first drilling was conducted in 2007. The results of the project’s Definitive Feasibility Study (DFS) in February 2024.

The DFS estimates that the lithium project would have a life of 21.1 years (LOM) with an average annual production rate of 300 kilo tonnes per annum (ktpa) spodumene concentrate.

Total capital expenditure (CAPEX) is estimated to be $722m.

The LOM includes a 39-month construction period, including pre-production, followed by a 19-year production period starting in April 2027.

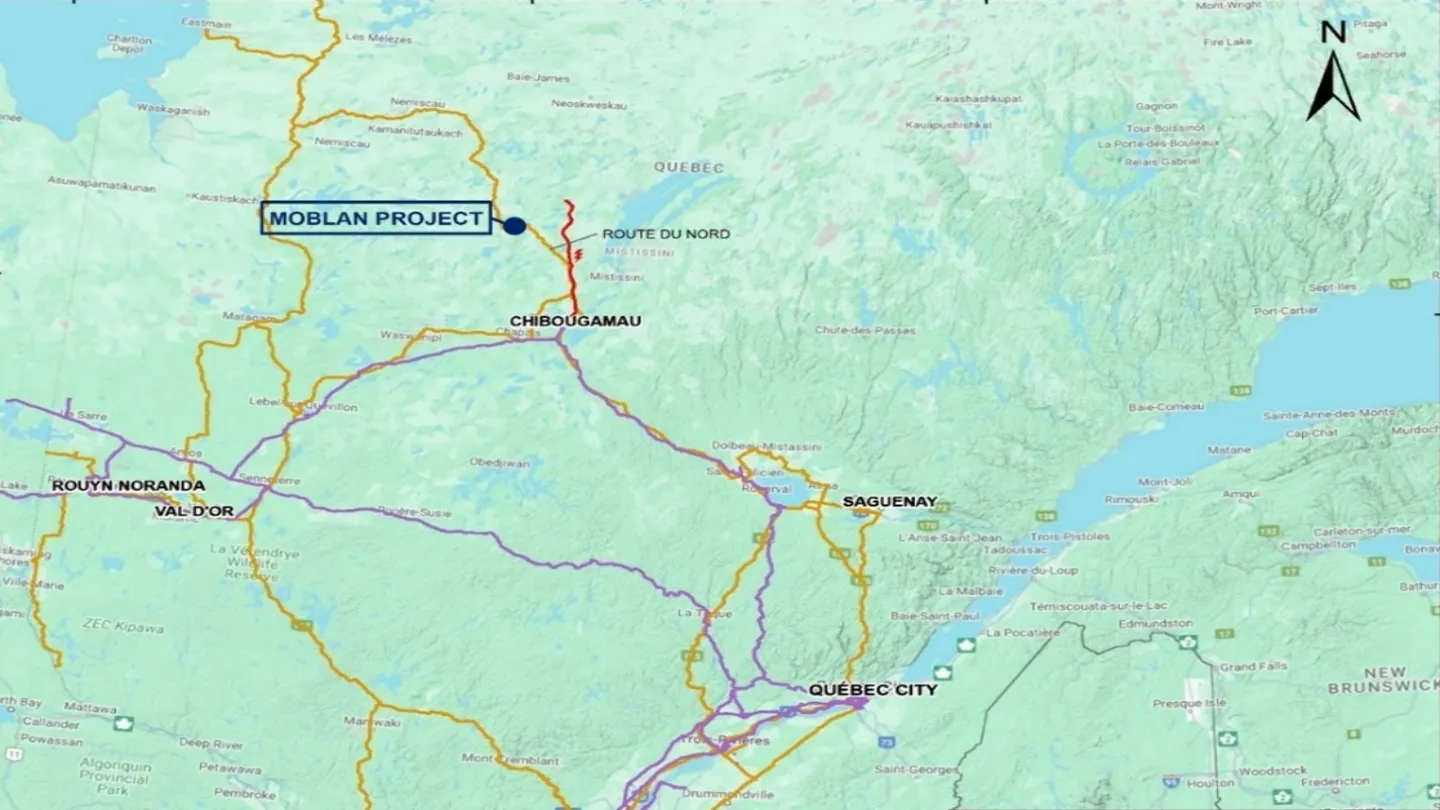

Moblan Lithium Project Location

The Moblan Lithium Project in the Eeyou-Istchee James Bay region of northern Québec. The site is around 130km northwest of Chibougamau via Route du Nord, a regional highway.

The highway provides access to the railway lines (Chibougamau Railway Hub) linking major ports in Eastern Canada.

The project is located 600km north of Montreal, 90km north of Oujé-Bougoumou, and approximately 85km from the Cree (First Nations) community of Mistissini.

Overall, Moblan consists of 20 claims covering 433 hectares (ha).

Geology and Mineralisation

The lithium project is host to lithium mineralised pegmatite with individual dykes that are documented includes the Main Zone, South Zone, Inter Zone, and Moleon Domain.

The property is within the Frotet-Evans Greenstone Belt (FEGB) as a part of the Archean Superior Province.

The geology is primarily dominated by gabbro rocks bordered by mafic volcanics to the northwest and lesser sedimentary rocks.

Gabbro hosts the main lithium-bearing pegmatites of an albite-spodumene class of Lithium-Cesium-Tantalum (LCT) pegmatites.

Four pegmatite groups form a series of stacked pegmatite dykes with different thicknesses.

Moblan Reserve Estimate

The measured mineral resource estimate of the Moblan Lithium Project is 6.31kt containing lithium oxide (Li2O) at a grading of 1.46%.

The indicated mineral resource of the mine is 43.57Mt containing Li2O at a grading of 1.16%, while the inferred mineral resource is estimated to be 20.98Mt containing Li2O at a grading of 1.02%.

The probable ore reserve of the lithium project is 34.53Mt containing Li2O at a grading of 1.36%.

Moblan Mining and Ore Processing Methods

The Moblan Lithium Project will be mined using open pit methods involving a conventional excavator and a truck fleet.

The owner-operated mining fleet will include six 92-tonne trucks, three 100-150mm drills with remote capabilities, and three 7m3 backhoes. The final design will consist of two open pits.

Over the LOM, 114.1Mt of ores will be mined from the open pits. This will include 4.1Mt of overburden, 34.5Mt of Li2O at a grading of 1.36%, and 75.4Mt of waste rock.

The ores will be processed in the Moblan spodumene concentrator via processing through DMS and flotation circuits.

The ores will be blended from the Run Of Mine (ROM) and low-grade stockpile to control iron and Li2O grade contamination.

The blended material will follow the processing circuits of the concentrator producing Li2O with an average grading of 1.45% over the first 10 years and 1.18% average grading in 2047 over the LOM.

The processing circuit will produce 14.4Mt per year of nominal DMS concentrate and 14.2Mt of flotation concentrate at a target grade of 6% Li2O.

Moblan Lithium Project Infrastructure

The project infrastructure will consist of mining, a concentrator, a multi-service building, a maintenance shop, auxiliary buildings, and an accommodation complex.

The mining facilities will include an assay laboratory, a mine fuel depot and fuel distribution facility, a mine explosive storage facility, and an electrical substation.

The concentrator will consist of various circuits from grinding to crushing and ore sorting.

Offices, an infirmary, a mine dry, engineering and administration will be components of the multi-service building.

The maintenance shop will house a mechanical and a welding shop, a warehouse, a wash bay, supervisory offices, administration offices, and a fire department.

Warehouse domes, a truck scale, gatehouses, and a fresh and fire water pump house will be the auxiliary buildings.

The accommodation complex will have a temporary camp for construction and a permanent camp with a kitchen, a gymnasium, and a dormitory.

A waste management and Tailings Storage Facilities (TSFs) will be constructed for the project. The TSFs will cover approximately 200ha with a capacity to contain 75.4Mt of waste rock and 28.7Mt of filtered tailings.

Moblan Lithium Power Transmission

The project will receive hydroelectric power. There is an option to construct a new 42km long transmission line connecting the existing HydroQuébec 161kV power line number 1625.

The tap connection of the power line will be between 563 and 564 structures.

The 161kV/25kV onsite substation will deliver 26.1MW power for mining and processing. The supply line will be constructed and maintained by a third party.

During emergencies, the power will be supplied by two 600V 1MW diesel generators and a 600V 500kW diesel generator.

Moblan Lithium Project Contractors

The 2023 DFS of the Moblan Lithium Project was completed by InnovExplo in collaboration with AtkinsRéalis (formerly SNC-Lavalin), Primero Group Americas, SLR Consulting, G Mining Services, and Richelieu Hydrogéologie.

AtkinsRéalis, InnovExplo, and Primero also completed many components of the Pre-Feasibility Studies (PFS) of the project.

The optimized mine schedule was prepared using Dassault System MineSched Software provided by Dassault Systèmes.

Petra Capital was the sole lead manager, book-runner, and underwriter to the A$200m ($135.22m) underwritten placement of May 2023 meant to expand Sayona’s Northern Lithium and Abitibi Lithium Hubs.