Rio Bravo wind project is a 238MW onshore wind farm under construction in Starr County, Texas, US. The $300m project is owned and will be operated by Sammons Renewable Energy (SRE) through its wholly-owned subsidiary, Rio Bravo Windpower.

The Rio Bravo wind project was previously owned by Longroad Energy Holdings, which undertook initial development activities including engineering, design, environmental and interconnection approval, turbine procurement, construction management as well as the financial closure for the project.

Construction on the wind farm was started in September 2018, while Sammons Renewable Energy, a wholly-owned subsidiary of Sammons Infrastructure, acquired the project in December 2018. KeyBanc Capital Markets served as the financial advisor to Longroad, while Franklin Park assisted SRE for the wind farm acquisition.

Scheduled to commence operations by the end of 2019, the Rio Bravo wind farm will generate clean electricity for approximately 76,000 Texas homes.

Rio Bravo wind farm turbine details

The Rio Bravo wind farm will be installed with 66 V136-3.6MW turbines from Vestas. With 66.7m-long blades, 136m-diameter rotor, and 105m-high tower hub, each of the onshore wind turbines will have a swept area of 14,527m².

The height, length, and width of the nacelle of each turbine will be 6.9m, 12.8m, and 4.2m, respectively. The gearbox of the turbine is composed of a planetary gear and two stages of helical gears.

Designed to operate at 3m/s cut-in and 22.5m/s cut-out wind speeds in -20oC to 45oC temperature range, each V136-3.6MW wind turbine will have a rated capacity of 3.6MW.

Power transmission

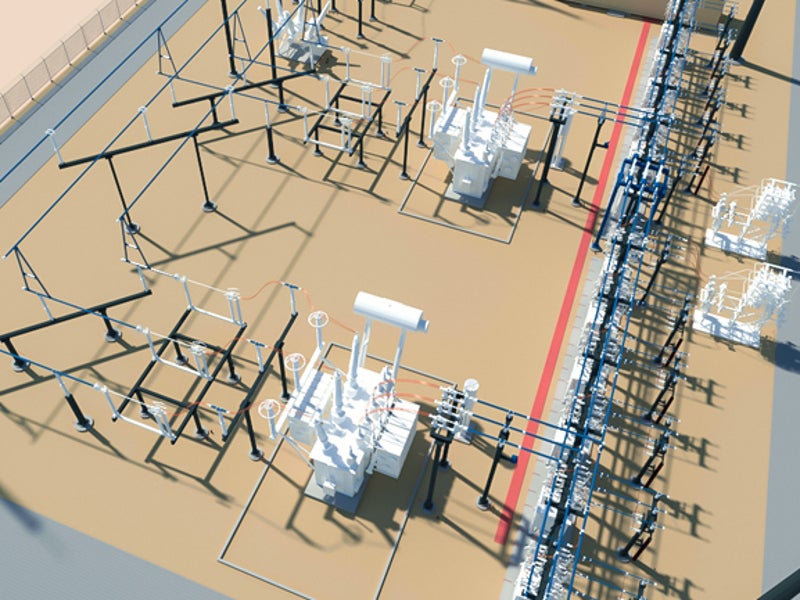

The electricity generated by the Rio Bravo wind turbines will be gathered and evacuated to the nearby 345kV Cabezon substation being built as part of the project.

The electricity from the substation will be further evacuated to the Electric Reliability Council of Texas (ERCOT) grid for transmission.

Power off-take

Citigroup will purchase 80% of the electricity output of the Rio Bravo wind farm under a 15- year energy hedge contract signed in May 2018.

QTS Data Centers entered a ten-year power purchase agreement with Citigroup to off-take the electricity from the Rio Bravo wind farm, in May 2019.

Financing

The financial closure for Rio Bravo wind project was reached in May 2018. Longroad Energy provided $100m in equity investment for the project, while a subsidiary of Berkshire Hathaway Energy agreed to provide equity tax.

A group of banks led by KeyBank also extended financing for the project, apart from other lenders including Zions Bank, HSBC, National Australia Bank, CIBC, and Landesbank Hessen-Thuringen.

Contractors involved

Mortenson, a construction and engineering company based in the US, is engaged as the engineering, procurement, and construction (EPC) contractor for the Rio Bravo wind project.

It is in charge of the construction of roads, operations and maintenance (O&M) building, turbine foundations, and meteorological towers for the wind farm.

Mortenson’s Engineering Services wing is also responsible for the design and supply of transmission infrastructure including the high-voltage substation, collection system, and transmission lines for the project.

Vestas was awarded the turbine supply and commissioning contract for the wind farm in June 2018. The contract also included a 20-year operations and maintenance service agreement for the wind turbines.

A subsidiary of Longroad Energy has been retained to provide balance-of-plant (BOP), monitoring, and asset management services for the Rio Bravo wind project.